In the world of cryptocurrency, a crypto wallet plays a crucial role in safeguarding digital assets. A crypto wallet is a software program or a physical device that allows users to store, send, and receive cryptocurrencies such as Bitcoin, Ethereum, and many others. Whether you’re a seasoned crypto investor or just beginning, understanding how a crypto wallet works is essential for securely managing your digital wealth. In this article, we’ll explore the different types of crypto Ledger hardware wallet, their features, and the best practices for keeping your digital assets safe.

What is a Crypto Wallet?

A crypto wallet is essentially a tool that stores your public and private keys. These keys allow you to interact with the blockchain and manage your cryptocurrency transactions. The public key is like an account number that others can use to send you cryptocurrency, while the private key is like a password that gives you access to your funds. The private key should always be kept secure, as anyone who possesses it can control the corresponding assets.

Crypto wallets are not responsible for holding cryptocurrencies in the traditional sense. Instead, they store the private keys required to access blockchain addresses, which are tied to your cryptocurrency. Cryptocurrencies are decentralized, meaning they’re not stored in a central repository but exist on the blockchain, a distributed ledger.

Types of Crypto Wallets

There are several types of crypto wallets, each with its own features, security levels, and user experience. The two main categories are Hot Wallets and Cold Wallets.

1. Hot Wallets

Hot wallets are connected to the internet, making them more convenient but also more vulnerable to hacking. They are often used for everyday transactions because they allow users to quickly send and receive cryptocurrencies.

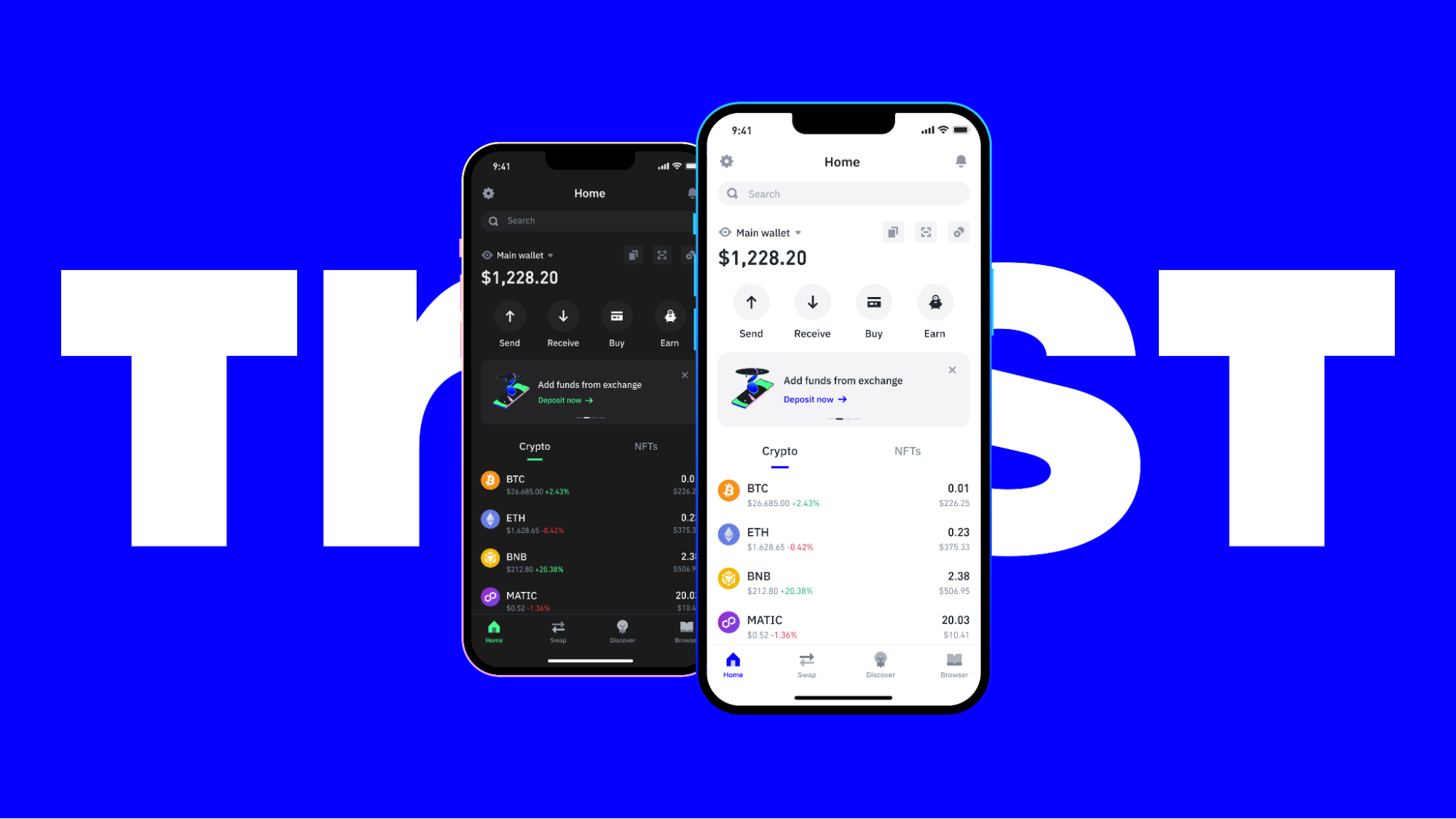

- Software Wallets: These are applications or programs installed on a computer or smartphone. Popular examples include Exodus, Electrum, and Trust Wallet. Software wallets are easy to use, making them ideal for beginners. However, they are more susceptible to malware and other online threats.

- Web Wallets: These wallets are accessed through a web browser and often provided by cryptocurrency exchanges like Coinbase and Binance. While they are accessible from any device, they are generally considered less secure due to the risk of phishing attacks and exchange hacks.

2. Cold Wallets

Cold wallets are offline wallets, offering much higher security levels. They are ideal for long-term storage of large amounts of cryptocurrency, as they are not susceptible to online attacks.

- Hardware Wallets: These are physical devices that store your private keys offline. Popular examples include the Ledger Nano S, Ledger Nano X, and Trezor. Hardware wallets are considered one of the most secure ways to store cryptocurrencies because they require physical access to the device to perform transactions.

- Paper Wallets: A paper wallet is a physical document that contains your public and private keys, usually in the form of QR codes. They are completely offline, reducing the risk of online theft. However, they are vulnerable to physical damage or loss.

Features to Look for in a Crypto Wallet

When choosing a crypto wallet, it’s important to consider several factors based on your needs and preferences. Some of the key features to look for include:

- Security: Look for a wallet that offers strong encryption, two-factor authentication (2FA), and other security measures to protect your private keys.

- Backup and Recovery: A good wallet should provide a way to back up your private keys or seed phrase. This is important in case your device is lost or damaged.

- User Interface: Choose a wallet with an intuitive and user-friendly interface. This is particularly important for beginners who may not be familiar with cryptocurrency concepts.

- Compatibility: Ensure the wallet supports the cryptocurrencies you want to store and is compatible with your device (desktop, mobile, or hardware).

- Control Over Private Keys: If you value full control over your assets, choose a non-custodial wallet where only you hold your private keys. Custodial wallets, often offered by exchanges, store your private keys on your behalf, which could be a security risk if the platform is compromised.