As the world becomes increasingly digital, the demand for secure methods of handling cryptocurrencies has skyrocketed. Whether you are an avid investor or someone simply curious about digital currencies, understanding the concept of a crypto wallet is essential. In this article, we will explore what Atomic wallet are, how they work, and the different types available.

What is a Crypto Wallet?

A crypto wallet is a digital tool that allows users to store, send, and receive cryptocurrencies like Bitcoin, Ethereum, and other altcoins. Unlike traditional wallets, which hold physical currency, a crypto wallet stores the private keys required to access and manage your cryptocurrency holdings on the blockchain. These private keys are unique cryptographic codes that allow you to authorize transactions, making them the heart of wallet functionality.

To put it simply, while you don’t physically “hold” cryptocurrencies like cash, your crypto wallet acts as the key to accessing and managing your funds stored on the blockchain.

How Do Crypto Wallets Work?

Crypto wallets are designed to interact with the blockchain, which is the decentralized ledger that records all cryptocurrency transactions. Here’s a breakdown of how a typical transaction works:

-

Private Keys: When you create a crypto wallet, it generates a private key (a secret code known only to you). This key is used to sign off on transactions, granting access to the cryptocurrencies associated with it.

-

Public Keys: Your public key is like an address that you can share with others. When someone wants to send you cryptocurrency, they use your public key to initiate the transfer. You can think of the public key as your email address, while the private key is like the password that unlocks access to it.

-

Transactions: When you send cryptocurrency, the transaction is broadcast to the blockchain, where it gets verified by network nodes. Once confirmed, the transaction is added to the blockchain, making it immutable and transparent.

-

Security: The security of your crypto wallet relies heavily on how well you protect your private key. If someone gains access to it, they can access your funds. On the other hand, losing your private key means losing access to your funds permanently. This is why securing your private key is paramount.

Types of Crypto Wallets

There are several types of crypto wallets, each offering different levels of security and convenience. Broadly, they fall into two categories: hot wallets and cold wallets.

1. Hot Wallets

Hot wallets are connected to the internet and are typically easier to use. They are best suited for people who need quick access to their funds for regular transactions.

-

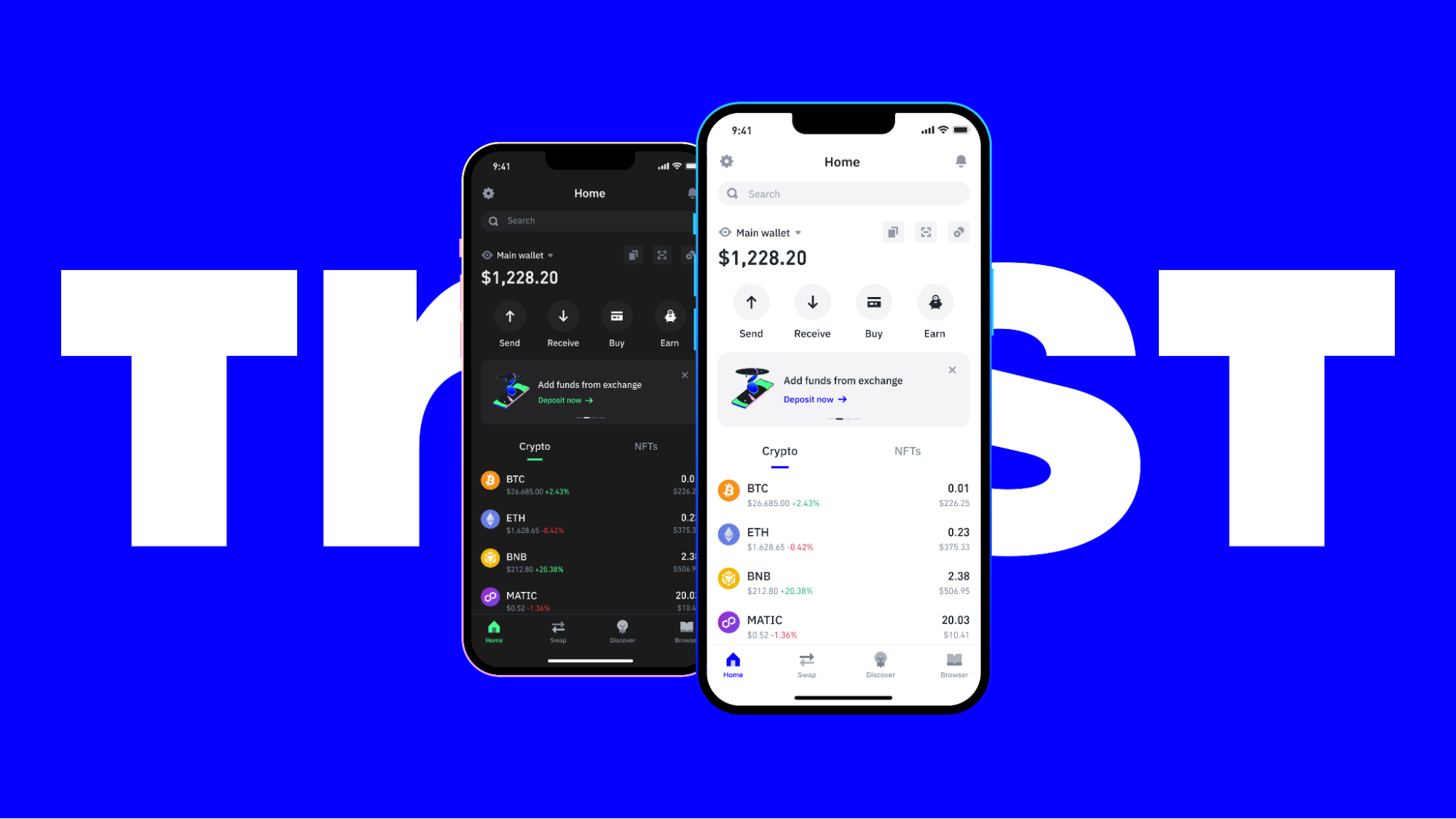

Software Wallets: These are apps or programs that can be downloaded to a computer or smartphone. Examples include MetaMask, Exodus, and Trust Wallet. They are free, easy to use, and allow for fast transactions, but they are more vulnerable to hacking since they are connected to the internet.

-

Web Wallets: Web-based wallets, such as Coinbase or Blockchain Wallet, store your private keys online. They can be accessed from any device with internet connectivity, providing easy access. However, the fact that the keys are stored online can expose them to risks if the wallet provider’s security is compromised.

2. Cold Wallets

Cold wallets are offline storage options, making them significantly more secure from hacking attempts. They are ideal for long-term storage of cryptocurrency.

-

Hardware Wallets: These are physical devices, such as Trezor or Ledger, that store your private keys offline. To use them, you must plug the device into a computer or mobile phone. While hardware wallets can be more expensive, they provide a higher level of security because they are immune to online hacks.

-

Paper Wallets: A paper wallet is a printed document that contains both your public and private keys. It is an offline method of storing your crypto information and is considered very secure as long as the paper is kept safe and undamaged. However, paper wallets are not practical for frequent transactions and can be lost or damaged easily.

Key Considerations When Choosing a Crypto Wallet

When choosing a crypto wallet, consider the following factors:

-

Security: Does the wallet offer strong encryption and backup options? Ensure you have a backup of your private keys and consider using two-factor authentication (2FA) for added protection.

-

Ease of Use: If you’re new to cryptocurrencies, you might prefer a wallet with a user-friendly interface. Make sure the wallet is compatible with the devices and operating systems you use.

-

Control of Keys: Some wallets (especially exchange wallets) store your private keys for you, while others give you full control over them. It’s essential to understand this distinction because it impacts the security of your funds.

-

Support for Coins: Not all wallets support every cryptocurrency. If you plan to hold multiple types of crypto, choose a wallet that can handle a wide range of tokens.

The Importance of Securing Your Crypto Wallet

With great power comes great responsibility, and securing your crypto wallet is paramount. Here are a few tips to help protect your wallet:

-

Use Strong Passwords: Always create strong, unique passwords for your wallet. Avoid reusing passwords across multiple platforms.

-

Enable Two-Factor Authentication (2FA): This adds an extra layer of security, ensuring that even if someone steals your password, they cannot access your wallet without a second form of verification.

-

Back Up Your Private Key: Always back up your private key or recovery phrase in a secure location. This ensures that even if you lose access to your wallet, you can restore your funds.

-

Use Multi-Signature Wallets: These wallets require more than one signature to authorize a transaction, offering an extra layer of security.

-

Avoid Public Wi-Fi: When making crypto transactions, avoid using public Wi-Fi networks, as they are often targeted by hackers.

Conclusion

A crypto wallet is an essential tool for anyone dealing with cryptocurrencies, providing a secure and efficient way to store and manage digital assets. Whether you choose a hot wallet for quick transactions or a cold wallet for long-term storage, it’s crucial to prioritize security to protect your investments. By understanding the different types of wallets and following best practices for securing your private keys, you can safely navigate the world of cryptocurrencies.